Overall customer growth:

The fintech industry has continued its upward trajectory post-COVID-19, maintaining the growth momentum seen both before and during the pandemic. This growth is evidenced by the increasing number of customers, serving as a reliable indicator of two key trends: enhanced access to digital financial services and heightened consumer interest in fintech offerings.

The first-ever Future of Global Fintech: Towards Resilient and Inclusive Growth report reveals that the global response has been a testament to the agility and innovative spirit that defines the fintech ecosystem.

Emerging from the aftermath of the pandemic as well as a potential economic crisis, the sector has not only rebounded but has shown an impressive expansion, with customer growth rates averaging above 50% across various industry verticals and regions around the globe.

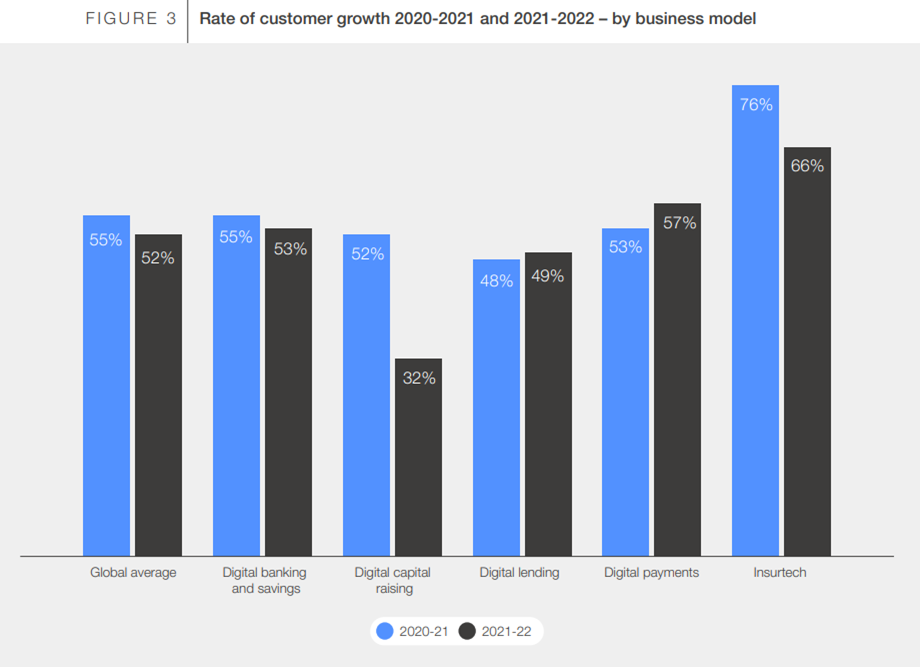

Notably, during the pandemic, the fintech sector showcased resilience, particularly in regions with stricter lockdown measures. From 2020 to 2022, the industry sustained robust customer growth, averaging over 50%. However, there was a slight downturn in annual growth rates from 55% to 52% between 2020-21 and 2021-22, possibly reflecting the initial surge in fintech adoption during the pandemic, followed by a temporary shift in consumer behavior as the pandemic receded. This dip underscores challenges in specific fintech segments, notably digital capital raising, in the post-pandemic economy, where the global venture capital landscape has experienced fluctuations.

Source: The Future of Global Fintech: Towards Resilient and Inclusive Growth. World Economic Forum and the Cambridge Centre for Alternative Finance

The major factors impacting fintech growth:

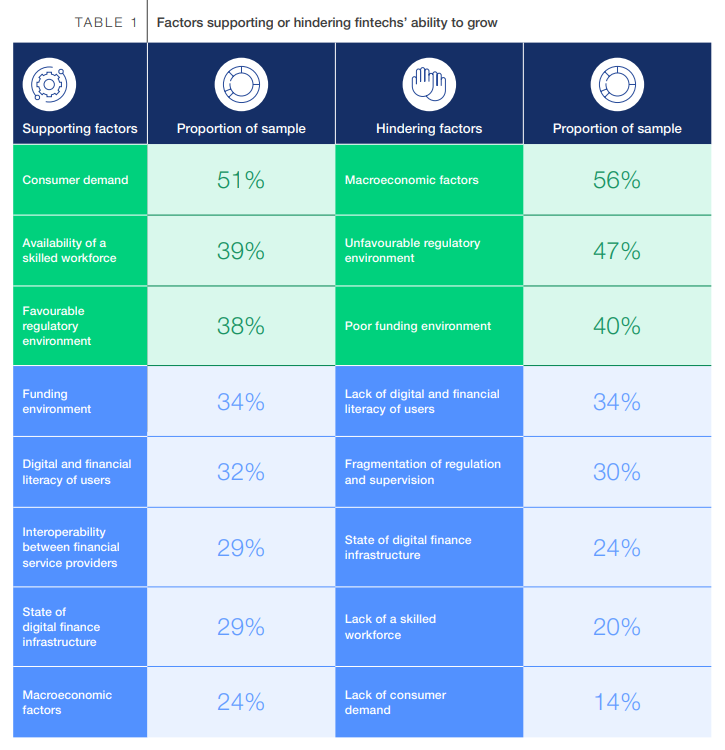

This chapter explores the factors impacting fintech growth from the perspective of fintech companies themselves, highlighting both supporting and hindering influences. Survey responses reveal that consumer demand, availability of skilled workforce, and favorable regulatory environment are key factors aiding growth, while macroeconomic conditions, unfavorable regulations, and funding challenges are significant obstacles. Notably, macroeconomic factors emerge as the primary hindrance, especially amid global high inflation and interest rates. The close relationship between funding environment and macroeconomics underscores their intertwined impact on fintech growth. Despite variations in supporting factors, regulatory environment consistently ranks among the top three influences for both facilitating and impeding fintech growth, emphasizing its crucial role in shaping the industry’s trajectory.

Source: The Future of Global Fintech: Towards Resilient and Inclusive Growth. World Economic Forum and the Cambridge Centre for Alternative Finance

Amidst challenging economic conditions impacting fintech’s worldwide, concerns about sustained growth and expansion have arisen. Nevertheless, the fintech industry remains resilient, continuously innovating and adapting to seek new avenues for growth and development. The regulatory landscape presents a nuanced scenario for fintech companies. While a majority perceive their regulatory environment as adequate, with 63% of surveyed fintech’s rating it favorably and 36% even considering it a significant supporting factor for their operational growth in recent years, a notable portion finds certain aspects of regulatory compliance, licensing, and registration to be burdensome.

Source: The Future of Global Fintech: Towards Resilient and Inclusive Growth. World Economic Forum and the Cambridge Centre for Alternative Finance

How fintech’s are creating a more inclusive financial system:

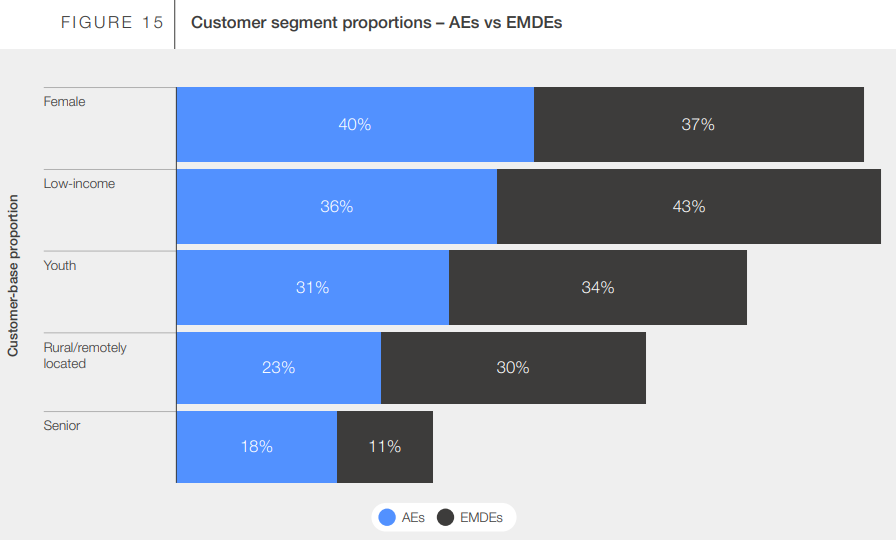

Traditionally, traditional banks have focused their lending practices on specific customer segments, typically those with well-documented financial histories and higher affluence, often residing in urban areas. This approach has left certain demographic groups, such as low-income individuals, with limited access to basic financial services, particularly prevalent in Emerging Markets and Developing Economies (EMDEs). Fintech companies and digital financial services have disrupted this pattern by leveraging digital technology and widespread mobile phone adoption to expand access and affordability of financial services. Their potential extends to the estimated 1.4 billion unbanked individuals globally and many more who are underbanked, particularly in regions with a higher proportion of traditionally underserved customer segments.

FinTech’s demonstrate a strategic inclination towards serving traditionally underserved customer segments, a move that significantly contributes to the expansion of their customer bases. Globally, female, low-income, and rural or remotely-located customers represent substantial proportions of fintech customer bases, comprising 39%, 40%, and 27%, respectively. These segments also contribute significantly to total transaction values, accounting for 39%, 26%, and 31% respectively. This trend persists across Advanced Economies (AEs) and EMDEs with minor variations. Notably, AEs’ fintech companies report a higher proportion of female customers compared to EMDE counterparts, while EMDE fintechs serve a larger share of low-income and rural or remote customers, relatively.

Source: The Future of Global Fintech: Towards Resilient and Inclusive Growth. World Economic Forum and the Cambridge Centre for Alternative Finance

An eye to the fintech future:

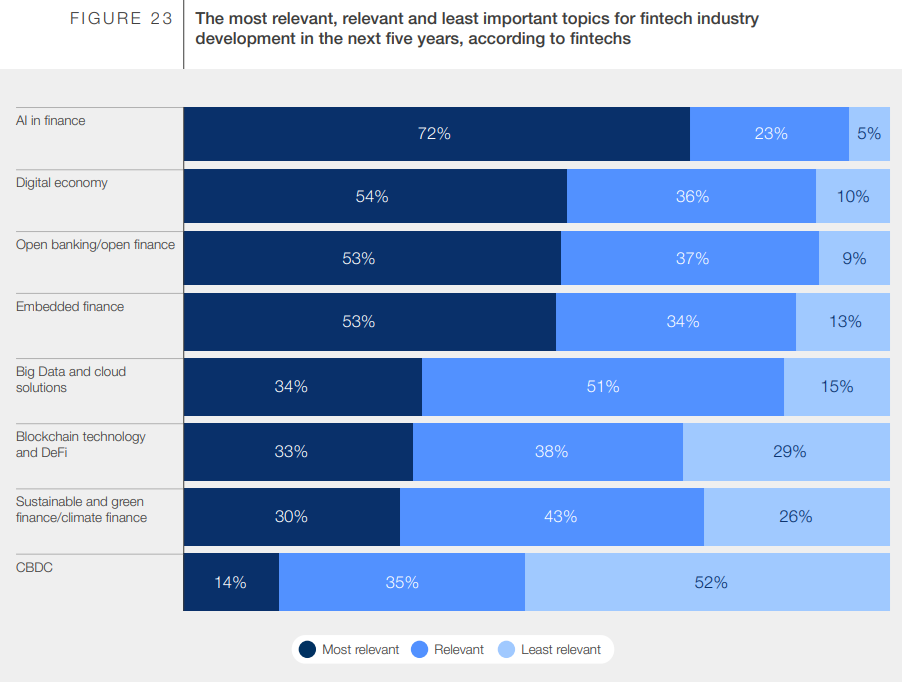

Fintechs view artificial intelligence as being the most relevant topic for fintech industry development over the next five years.

As the inaugural report within the Future of Global Fintech research initiative concludes, it looks ahead to the evolving landscape of the fintech industry over the next five years. Fintech companies were surveyed to identify the most relevant topics and issues for industry development. Notably, artificial intelligence (AI) emerged as the consistently cited top priority across nearly all verticals, with its impact expected to permeate various aspects of fintech, including business models, customer engagement, and regulatory compliance. Additionally, embedded finance, the digital economy, and open banking were closely ranked as the next most relevant factors, reflecting fintechs’ anticipation of continued growth in digital platforms, fostering the digital economy and facilitating the proliferation of embedded finance products. Open banking and open finance are anticipated to play pivotal roles in enabling widespread data sharing with customer consent, fostering further innovations in business models and product offerings.

Source: The Future of Global Fintech: Towards Resilient and Inclusive Growth. World Economic Forum and the Cambridge Centre for Alternative Finance

Consumer Growth and Strategic Customer Acquisition:

The fintech sector’s resilience throughout the pandemic has been remarkable, driven by a sustained interest in digital financial services. However, as we transition into the post-pandemic era, new challenges arise in maintaining growth momentum. Fintech companies are actively exploring innovative strategies for customer acquisition to navigate this evolving landscape.

In regions with lower digital penetration, localized marketing efforts and strategic partnerships with traditional financial institutions have proven to be particularly effective. Data from organizations like CCAF and WEF highlight the importance of tailored approaches to market expansion, emphasizing the need for customized solutions to address unique regional dynamics.

Despite the shifting landscape, fintech firms remain steadfast in their commitment to financial inclusion. By prioritizing traditionally underserved demographics, these companies not only expand their customer bases but also contribute to broader societal goals of reducing financial inequality. This strategic emphasis on inclusion is evident across all fintech verticals, reflecting an industry-wide dedication to fostering equitable and sustainable growth.

Balancing Regulation and Innovation: Market-Driven Solutions in Fintech:

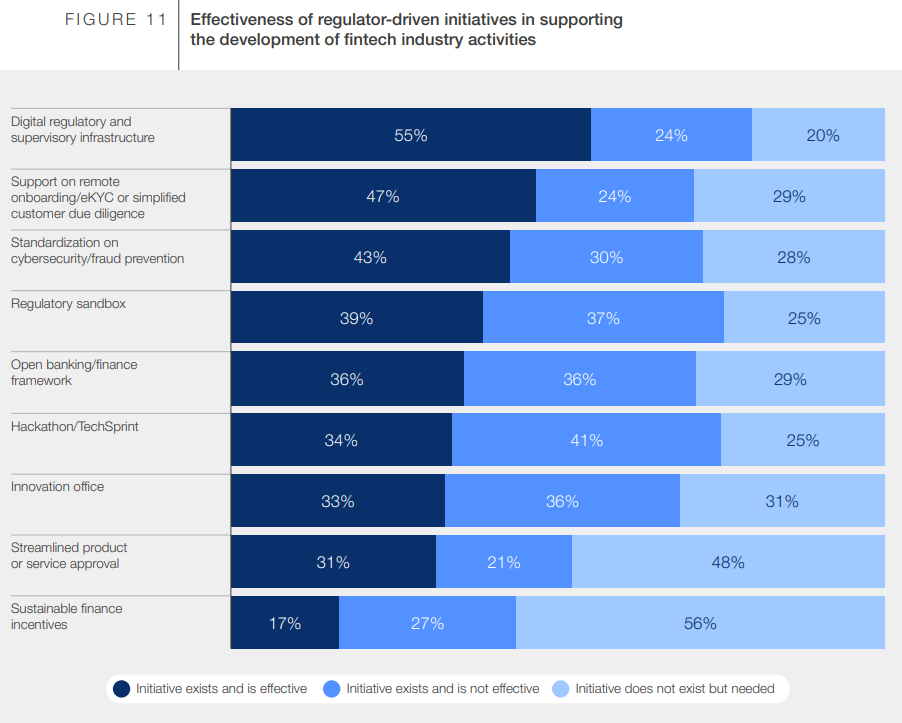

Fintech firms face a multifaceted challenge in navigating the regulatory landscape, requiring a delicate balance between innovation and adherence to compliance and consumer protection standards. Despite the inherent complexities, regulatory environments in numerous jurisdictions are undergoing transformation to facilitate fintech growth. There’s a noticeable shift towards fostering an environment conducive to digital finance, reflecting a recognition of the sector’s potential and the importance of enabling innovation while safeguarding consumer interests.

Source: The Future of Global Fintech: Towards Resilient and Inclusive Growth. World Economic Forum and the Cambridge Centre for Alternative Finance

Sustainability and the Road Ahead:

Looking ahead, the fintech sector is increasingly recognizing the imperative of integrating sustainability into its products and services. There’s a notable shift towards considering environmental, social, and governance (ESG) criteria, mirroring wider societal movements towards responsible and sustainable business practices. This strategic focus on sustainability, combined with ongoing technological advancements, positions the fintech industry as a pivotal player in fostering a more inclusive and environmentally conscious financial ecosystem.

In summary, the trajectory of the fintech industry is characterized by a blend of opportunities and challenges. From leveraging the potential of AI to navigating regulatory landscapes and championing financial inclusion, fintech firms are leading the charge in reshaping the financial services landscape. As the sector continues to evolve, its ability to adapt to changing consumer preferences, technological innovations, and economic dynamics will be critical. Looking forward, the journey promises further innovation, expansion, and a lasting impact on the global financial ecosystem, driven by a steadfast commitment to inclusivity and sustainability.