NEWS FLASH: Agahe Pakistan Surpasses 2-Billion Gross Loan Portfolio.

In a groundbreaking achievement, Agahe Pakistan proudly announces the attainment of a 2-Billion Gross Loan Portfolio milestone as of March 2024. This remarkable feat underscores the institution’s unwavering dedication to fostering financial inclusion among low-income individuals, particularly women and youth, through the provision of microfinance facilities.

Since its inception, Agahe Pakistan has disbursed over PKR 13 billion across 300,000 micro loans, aimed at bolstering income generation activities at the grassroots level. These loans span various sectors, including agriculture, livestock, enterprise, renewable energy, and education.

Notably, an overwhelming 99% of these loans have been extended to female borrowers, exemplifying Agahe Pakistan’s commitment to promoting women’s economic empowerment.

Expressing gratitude, the organization acknowledges the pivotal role played by its board of directors in providing oversight and strategic guidance, the management team for their dedication and loyalty, and the tireless efforts of field staff.

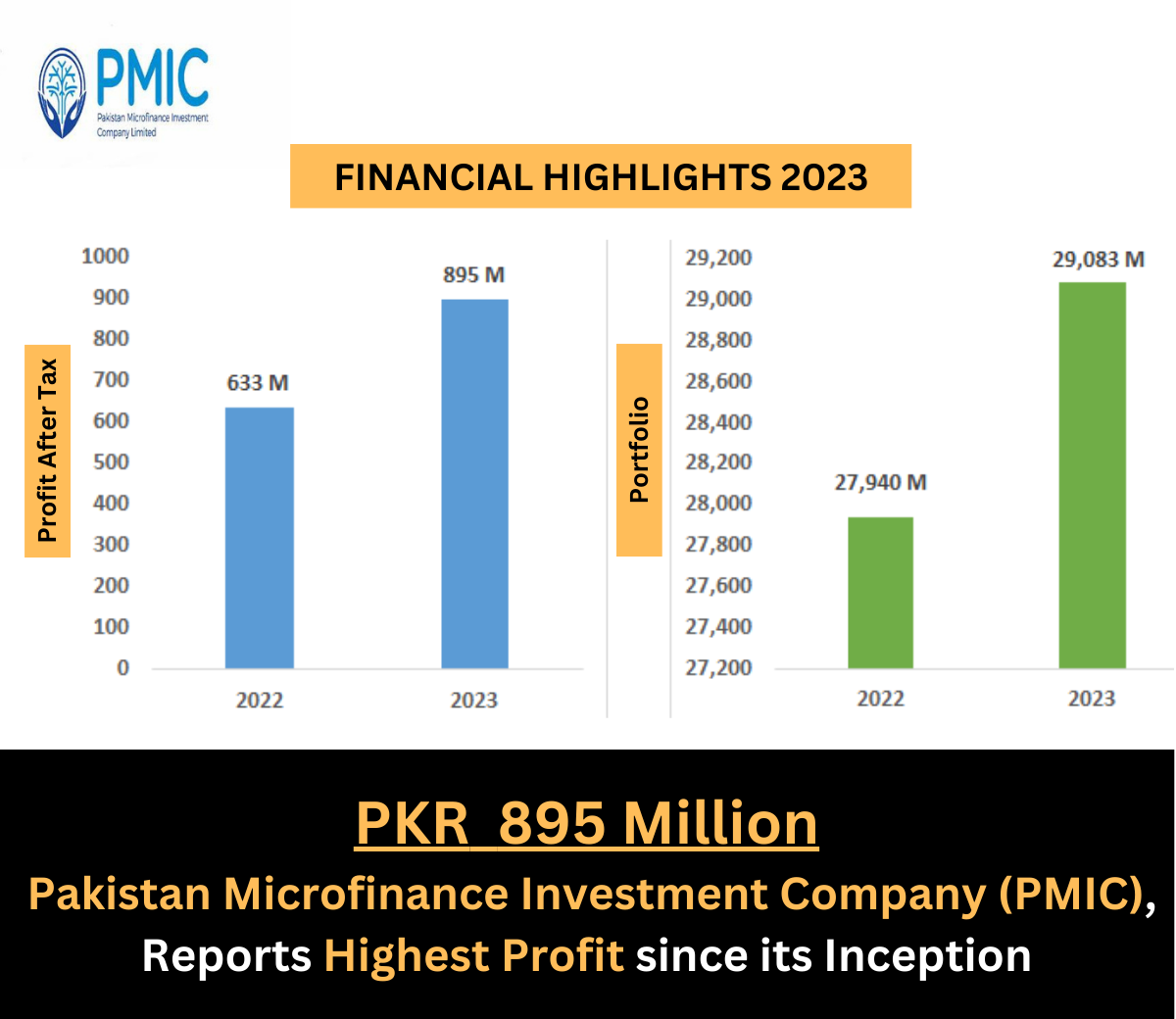

Furthermore, Agahe Pakistan extends heartfelt appreciation to its stakeholders, including lenders and partners such as Pakistan Microfinance Investment Company, National Bank of Pakistan, The Bank of Punjab, JS Bank, State Bank of Pakistan (SBP), Pakistan Poverty Alleviation Fund, Pakistan Microfinance Network, and SECP. Their unwavering support and trust have been instrumental in creating a conducive regulatory environment for Agahe Pakistan’s operations.

This significant milestone not only underscores Agahe Pakistan’s commitment to financial inclusion but also heralds a new era of empowerment and opportunity for marginalized communities across the nation.